Sales Tax and Property Tax

The sales tax in Moore, charged on purchases, is currently 8.5%. Of this amount the city receives 3.875%, the state 4.5% and Cleveland County 0.125%. Sales tax is the primary revenue source for the City and funds necessary services. On average, 64% of the City's revenue comes from sales tax.

The City of Moore's day-to-day operations, like all other cities and towns in Oklahoma, are primarily funded by revenue from sales tax. That's because Oklahoma is the only state in the nation where cities depend almost entirely on sales tax for general operations. By state law, cities are prohibited from levying property taxes for general operations, which forces the heavy reliance on sales tax. Property taxes in Oklahoma primarily fund county services and school districts.

This is why it is so important to shop inside the city limits of Moore. When you shop in other metro area cities, you are investing in their police and fire services, helping to repair their city streets, and maintaining their city parks. We wanted to share this important information because many residents don't realize that shopping in other cities improves the quality of life in those cities, rather than here in Moore.

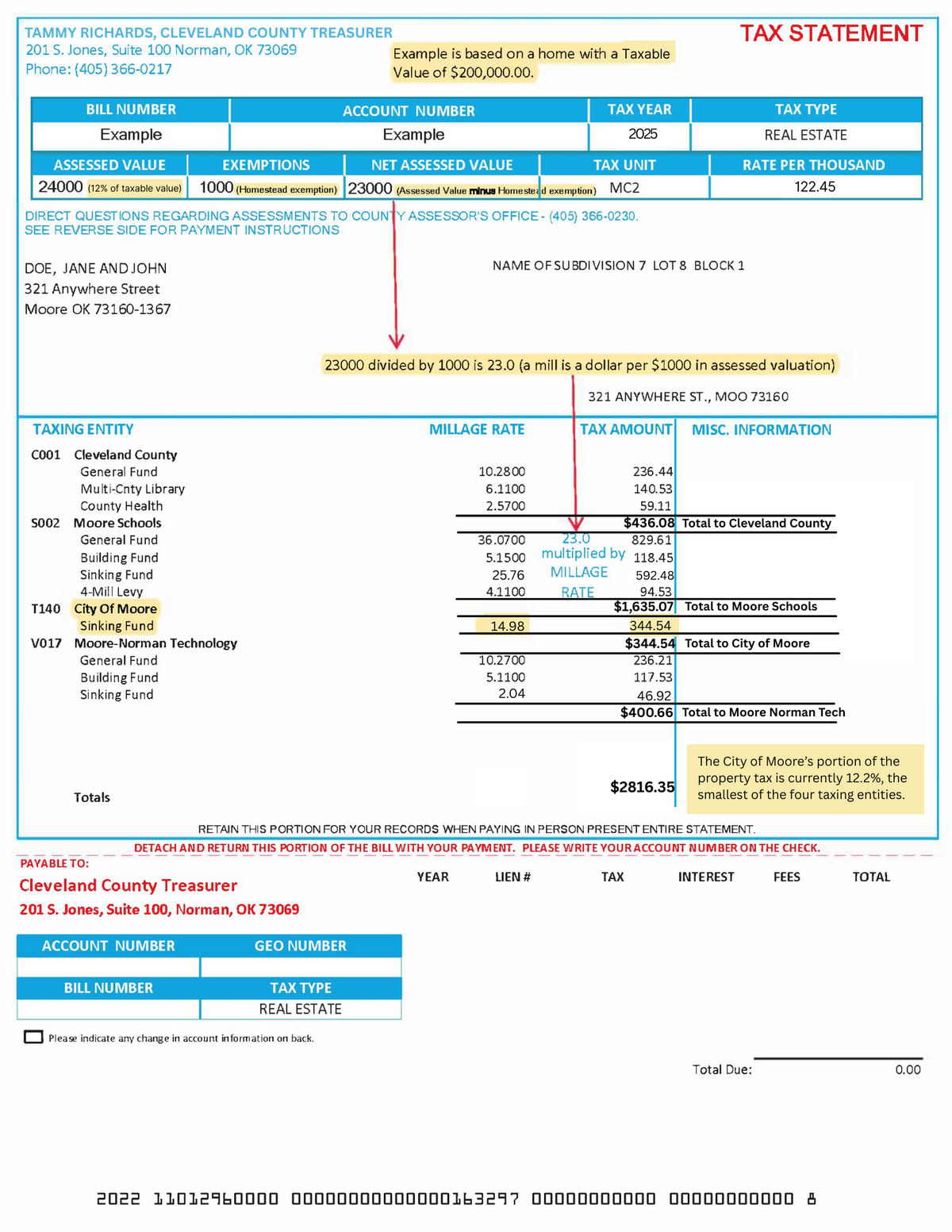

Tax levies are referred to as “millage” and are calculated as dollars per thousand. This means that you are taxed $1 for every $1,000 of assessed value of your property. Taxes are figured by taking the assessed value of your property and multiplied by overall millage rate for your taxing district. Currently, residents of the City of Moore have 4 taxing entities; Cleveland County, Moore Schools, Moore Norman Technology Center and the City of Moore Sinking Fund. The City of Moore's portion of the total property tax is currently 11.9%, which is the lowest of the four taxing entities.

| 2025 | 2024 | 2023 | 2022 | 2021 | 2020 |

| 14.98 | 14.50 | 15.45 | 15.31 | 15.42 | 15.49 |

Most of the funding for the city comes from sales tax however, if a bond in your city is approved by the voters, a portion of your property taxes go in to the city sinking fund.

City Sinking Fund – This fund applies to properties that are subject to city millage. Whenever any bonds for the city are approved, this portion of your property taxes is set aside for repayment on the interest and principal of those bonds. This fund is also reserved for any payment of any judgements against the city.

For additional information or questions about property valuation, assessment and tax levies, please visit the Cleveland County Assessor's website https://clevelandcountyok.com/129/County-Assessor or call their office 405-366-0230.

Example of Tax Statement